Both registrants are. Schedule 1 Part I Schedule 1 Part II Schedule 2.

Notice Concerning Fiduciary Relationship 1219 05202020 Inst 56.

. Child tax cedit or the cr edit for other dependents such as the r foreign tax cedit education cr edits or general business cr editr Owe other taxes such as self-employment tax household employment taxes additional tax on IRAs or other quali ed retiement plans and tax-favor ed accountsr. Copy of NRIC front and back AND. Instructions for Form 56 Notice Concerning Fiduciary Relationship.

Please make only one entry per year. Application for Enrollment to Practice Before the Internal Revenue Service 1020 09302020 Form 56. Print below in date order your self-employment earnings.

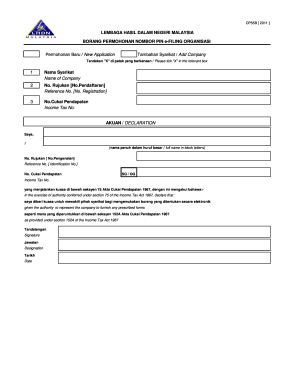

For years you believe our records are not correct. Occupational Tax and Registration Return for Wagering 1217 12212017 Form 23. Pastikan semua Borang Nyata Cukai Pendapatan telah dikembalikan dalam tempoh Ensure all Income Tax Return Forms have been submitted within the stipulated period.

Visitors to find travel records. Salaried Employment in Singapore Fixed and Commission Earner. If the name of a living owner or principal coowner of the bonds is eliminated from the registration the owner or principal coowner must include the interest earned and previously unreported on the bonds to the date of the transaction on his or her Federal income tax return for the year of the reissue.

Latest income tax notice of assessment or latest 6 months CPF Contribution history statement. I-94 is a place for US. Years of self.

Federal means-tested public benefits include food stamps Medicaid Supplemental Security Income SSI Temporary Assistance for Needy Families TANF and the State Child Health Insurance Program SCHIP. Borang STM1 hendaklah dilengkapkan dengan sempurna untuk semua permohonan Sijil Taraf Mastautin STMSTM1 Form. 6 months payslips commission statement OR.

You are not required to provide the information on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Trade or business name and business address. State Means-Tested Public Benefits Each state will determine which if any of its public benefits are means-tested.

We need it to insure that taxpayers are complying with these laws and to allow us to figure and collect the right amount of tax. Determine if there has been a violation of Income Tax Law. 3 months payslips 3 bank statement if required OR.

If you do not have self-employment income that is incorrect go on to item 10 for any remarks and then complete Item 11. We would like to show you a description here but the site wont allow us. Borang BE with LHDN Acknowledgement Receipt.

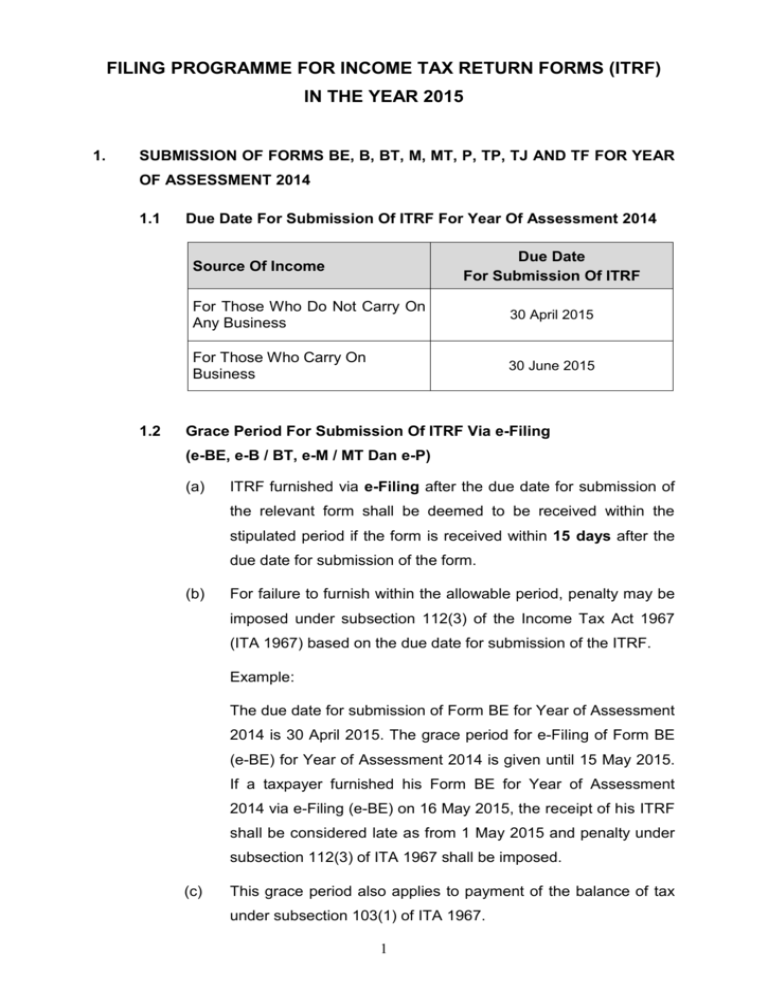

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Borang Tp1 The Lesser Known Tax Relief Form Your Employer Did Not Tell You About

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Program Memfail Borang Tahun 2009 Dan Isu

How To Step By Step Income Tax E Filing Guide Imoney

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

How To File For Income Tax Online Auto Calculate For You

Income Tax Form Ea 4 Why Income Tax Form Ea 4 Had Been So Otosection

Lhdn Form Pcb Tp3 1 2021 Ss Perfect Management Facebook

Borang Cp55d Form Fill Out And Sign Printable Pdf Template Signnow

What Is Borang E Every Companies Need To Submit Borang E Otosection

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

Anas Sazali Anas Sazali Added A New Photo

Important Dates For 2022 Tax Returns Leh Leo Radio News